Uber eats taxes calculator

The service fee Uber Eats charges its drivers depends on the method of transportation used. Weve established a Door-to-Door Safety Standard to help you feel safe every time you ride.

Uber Gst Explained The Complete Guide To Gst For Uber Drivers

Just open the app and enter where you want to go and a.

. Based on spend before promotions and discounts excluding taxes fees and tips spent on all Uber rides. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z. Of 271 FTC complaints MarketWatch obtained and examined about 64 were by Uber Eats workers 18 were by DoorDash workers 16 were by Instacart workers and 2 were by Grubhub workers.

For bicycles the service fee is 30. And with Uber your destination is at your fingertips. Your taxes will be like most small business owners where its known as pass-through taxation.

Yes you need to pay tax if you drive for Lyft Uber or similar companies like Uber Eats and other ride-share companies. What Percentage Does Uber Eats Take from Drivers. Including a 10 Self-Employment Tax with the IRS.

Can I pay for an Uber Eats order with an Uber gift card. 7 Earn 1 point for every 1 CAD spent on all Uber Eats food delivery and food pick up orders made in Canada through the Uber or Uber Eats app of 25 CAD or more. Within the gig economy its common for people to work as both ride sourcing drivers and food delivery riders.

Use the calculator and read our guide to find out everything you need to know. That means youre self-employed and will pay taxes as a sole proprietor unless youve created a formal business entity like an LLC. Shes been working in personal and small business tax for 13 years and has been specialising in tax for Australian Uber Drivers for the last 5 years as the Director of DriveTax.

These types of expenses again can. Revenue more than doubled to 81 billion from 393 billion in the year-ago. Uber Eats and investments in further expanding the delivery business.

You need to register your restaurant with Uber Eats first and they will supply a unique ID. Uber Eats branded bags can only be ordered through the Detpak Uber Eats portal. However much of this is similar for other gigs like.

Uber Cash and Uber VIP status is. Discount varies by your Uber Pro status. Explore the top cuisines for delivery in Dublin.

Uber Cash and Uber VIP status is available to Basic Card Member only. The main exception is that you dont have to pay income taxes if your total annual income is less than the standard deduction which is 12550 if youre a single-filer for 2021 taxes what you file in early 2022 and. These days Im a trusted media expert on all things rideshare and have a number of contributors across the country who are all driving for Uber and Lyft and other gig companies.

So much so that by 2021 the revenues from the delivery business represented about 48 of the companys total revenues. Jess is on a mission to make taxes straightforward and manageable for Uber drivers across Australia. Use our calculator to determine your free checked baggage allowance.

Uber first tried to buy DoorDash in. Uber and UberEats drivers can save up to 50 on Turbo Tax products. If you deliver for UberEats and drive for Uber or split your time between ridesharing and food-delivery driving you will need to register for GST.

One online earnings calculator shows that the average Uber drivers annual salary in the United States is approximately 29000. Subtract 56 cents per mile that you recorded on your mileage log 2021 tax year 585 for 2022. I started driving for Uber and Lyft in 2015 and eventually quit my day job as an aerospace engineer to run The Rideshare Guy full time.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Uber said the loss included 17 billion in losses related to the revaluation of its Aurora Grab and Zomato stakes. Add up all your Doordash Grubhub Uber Eats Instacart and other gig economy income.

In 2021 Uber kept consolidating its position in the delivery business. Delivered with Uber Eats in Dublin. Traveling is a lot easier with Uber.

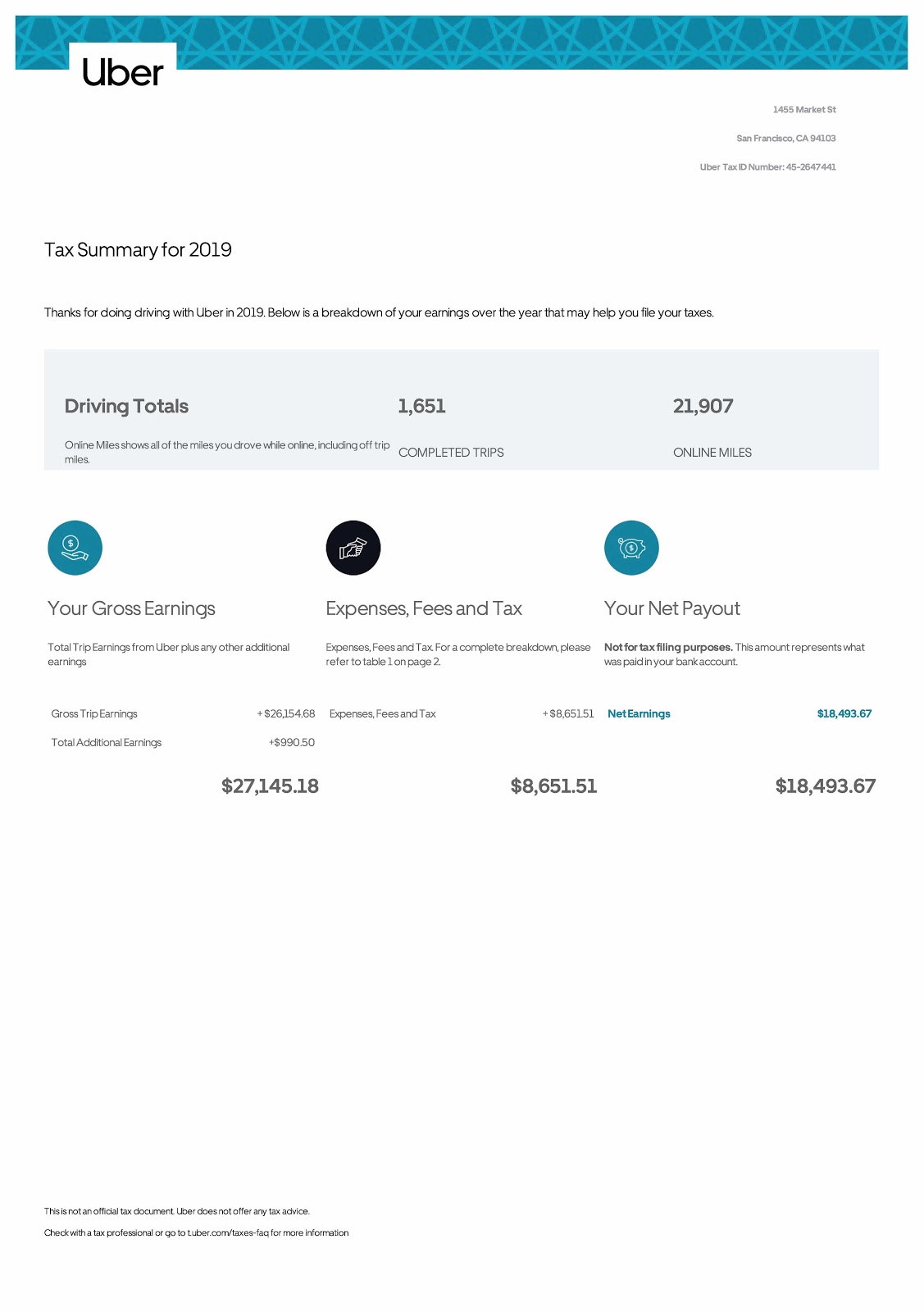

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. All Taxes Best tax software. Uber breaks this out for you in the tax summary image above.

Enjoy Uber VIP status and up to 200 in Uber savings on rides or eats orders in the US annually. This guide for riders gives you ideas for planning your transportation things to do and local meals. She also teaches an online course called Understanding Uber Taxes.

For 2021 taxes Uber is continuing its partnership with TurboTax. Mortgage Calculator Loans. Uber is also offering a taxes FAQ page you can access here.

This Uber Eats tax calculator focuses on Uber Eats earnings. Get up to 25 back each month on the Equinox digital fitness app or eligible Equinox club memberships when you pay with your Platinum Card. From a tax perspective this can make your taxes tricky.

Shes been working in personal and small business tax for 13 years and has been specialising in tax for Australian Uber Drivers for the last 5 years as the Director of DriveTax. GO TO THE PORTAL. Business profits become your personal income and taxes for your business are paid on your personal tax return.

Enjoy Uber VIP status and up to 200 in Uber savings on rides or eats orders in the US annually. Commercial vehicles may be subject to additional state government taxes which would be over and above the toll. The delivery business has become the most interesting part for Uber.

Being a food delivery driver for other gigs like Doordash Grubhub Instacart etc. Jess is on a mission to make taxes straightforward and manageable for Uber drivers across Australia. Were committed to your safety at Uber.

Uber Eats drivers are also at the mercy of changing demand food preparation wait times and recalcitrant tippers. This article is not meant to completely explain taxes for Uber Eats drivers. Get 247 customer support help when you place a homework help service order with us.

She also teaches an online course called Understanding Uber Taxes. For scooters and cars the service fee is 25. Uber Drivers Lyft drivers and other rideshare drivers.

200 Uber Cash. How to order your Uber Eats Bags. Once you have your Restaurant ID you can register an account to order bags through the portal.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Payments Taxes Income Uber Drivers Forum For Customer Service Tips Experience

How Do Food Delivery Couriers Pay Taxes Get It Back

Does Uber Track Your Miles

How Do Food Delivery Couriers Pay Taxes Get It Back

Uber Eats And Other Delivery Drivers Here Are The Tax Deductions To Maximize Refund In 2021 Accurate Business Accounting Services Campsie Tax Returns 49

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

How To File Your Uber Driver Tax With Or Without 1099

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart Instacart Rideshare Grubhub

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide

How Do Food Delivery Couriers Pay Taxes Get It Back

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

How To File Your Uber Driver Tax With Or Without 1099

Uber Vat Compliance For Belgian Uber Eats Delivery Partners